Connect Us

Connect Us

Jul 06, 2023

Jul 06, 2023

Global Backdrop

Boardrooms across the world are navigating a volatile and complex business landscape. Geopolitical tensions have heightened considerably over the past 12 months. For many Indian companies, it is affecting either their export markets, their status within the global supply chain link, and/or their ability to attract capital/investors.

Even while India remains predominately self-sufficient and unfazed by global developments, it cannot operate in total isolation for long and I say this because we are fast-exhausting planetary boundaries of crucial resources while on the other hand, our population grows unabatedly.

The whole premise of economic and civic risk(s) insulation is deeply flawed and is increasingly getting porous.

Current State of ESG & Sustainability

Boards are encouraged to view sustainability not only as an elephant in the room as far as risks are concerned but also as an opportunity to protect and create stakeholder value. Board members may well need to rethink how they allocate capital to both new and existing businesses. Re-thinking corporate strategies will likely involve identifying how good governance could support the company to accelerate its transition to a net-zero business model; as well as addressing issues like biodiversity loss or social inequality where they materially arise from the company’s operations across their value chain.

Companies Act’s 2013, Section 166(2) reverberates with the financial model of shareholder-driven ESG. It entails directors to pursue long-term interests of the company rather than the short-term benefits. The provision also requires directors to specifically account for the interests of non-shareholder constituencies. An important duty of directors also relates to transparency.

In India, the absence of statutory compliance requirements regarding ESG & Sustainability, in order to demonstrate a stronger commitment to ESG, a good number of blue-chip companies in India from diverse sectors have constituted ‘voluntary’ ESG committees, either at the board level, or management level, or cross-functional ESG committees, as can be seen from published reports from Infosys; Godrej; Biocon; Welspun; Bharati Airtel; Mindspace; Embassy; Lodha; Glenmark; Axis; ICICI; RBL Bank and Nippon Life India among others.

While there are others who have resisted and it has been down to multilateral development banks lenders, EU taxonomy compliant investors; proxy advisory firms, and shareholder activism (negligible) to nudge such companies to demonstrate their ESG commitments and claims.

Although there have been some legislative and regulatory measures towards ESG in India, they remain sub-optimal to attract the likes of Article 9 EU investors and the efforts thus far can only be summarised as early-stage work-in-progress.

Key ESG Considerations for Future-Proof Boards

ESG Maturity

Discussions around the concept of sustainability historically focused on ethics or compliance and have evolved to mainly focus on business risks. While each executive role sees sustainability through a different lens, it is usually focused primarily on the material risk agenda. However, a rising number of companies now look at sustainability as an opportunity for business

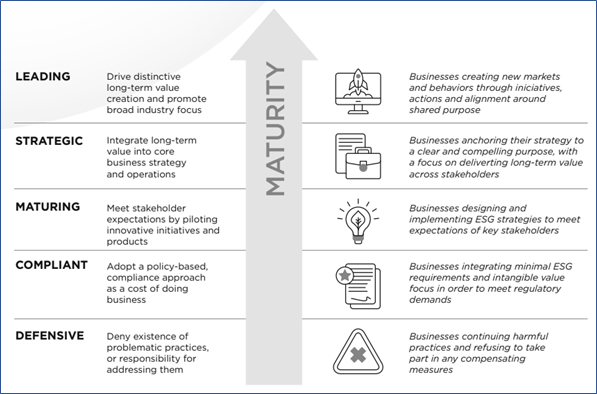

Thus, some blue-chip Indian companies seeking to maintain their global competitiveness may move beyond tolerating minimum performance against consensus ESG benchmarks and accelerate to best-in-class ESG policies, identifying propositions with unique worth and doing things differently. To start any change, Boards must acknowledge a spectrum of ESG maturity levels, understand where their company stands, and what level it wants to reach in the long term.

Incentivizing ESG: Carrots & Sticks

Incentivizing ESG: Carrots & Sticks

While management drives the execution of the sustainability agenda, it is the board’s role to hold management accountable to ensure ESG is appropriately integrated into the overall business strategy. At the board’s disposal are several accountability mechanisms:

A. Tying Management pay with ESG Performance

B. Tying specific ESG KPIs to executive compensation is already a best practice in larger organizations Note:

Eventually, there is a lot of expectation from the anticipated release of IFRS – International Sustainability Standards Board (ISSB) standards that will become the global gold standard of financially material integrated sustainability reporting. In a rising rate environment with precarious geopolitics at play, capital and growth are interlinked with sustainability.

Quote: To start any change, Boards must acknowledge a spectrum of ESG maturity levels; understand where their company stands, and what level it wants to reach in the long term.

She is a Non-executive Director at Neo Securities Ltd and Senior Vice President with sustainability and sustainable finance with Singapore Exchange. She is a Climate Safe Lending Network Fellow, a Senior Executive Fellow, Harvard Kennedy School and is also a Lifetime Fellow of the Institute of Directors (IOD). She has participated in the Taxonomy working group (HDFC – Special Invitee) in the development of India’s Sustainable Taxonomy that is led by the Ministry of Finance, Department of Economic Affairs and she has also been involved with FICCI led UK-India Economic and Financial Dialogue (EFD).

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories