Connect Us

Connect Us

Nov 06, 2023

Nov 06, 2023

Introduction

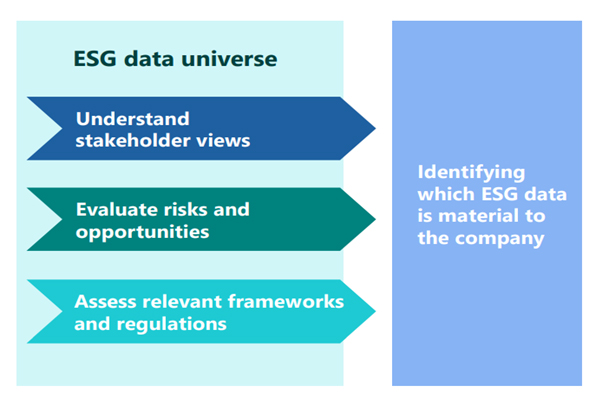

In common parlance, materiality is used to ‘filter in’ the information that is or should be relevant to users and is a key concept in corporate disclosures. In the context of Environmental, Social and Governance (ESG) reporting, materiality assessment can be referred to as a process designed to gather insight on the relative importance of specific ESG issues through stakeholder engagement. The insights gathered are used to decide content design for ESG reports, guiding communications strategies for individual stakeholder groups such as investors, analysts, customers, partners, and employees. These insights are also valuable for the organisation’s strategic planning, operational management, and capital investment decisions.

The role of materiality assessment is extended to ensuring that all key ESG aspects are covered and the ESG report presents a true and fair view of sustainable performance. In view of this, globally, regulators are demanding materiality assessment as a pre-requisite for the preparation of the ESG report. It is agreed by all that to be valuable and credible, the development of ESG reporting practices depends on a holistic approach based on material ESG matters and not merely the extraction (and in some cases extrapolation) of historic ESG data within organisations.

Double Materiality

Materiality in ESG context has to be evaluated both from “financial materiality” and “impact materiality” angle. Global Reporting Initiative (GRI) has explained concept of double materiality as, ‘topics that reflect an organisation’s most significant impacts on the economy, environment, and people, including impacts on human rights”.

The European Financial Reporting Advisory Group (EFRAG) defines double-materiality [1] from the perspective of both ‘financial materiality’ and ‘impact materiality’. Impact materiality involves “identifying sustainability matters that are material in terms of the impacts of the reporting entity’s own operations and its value chain (impact materiality), based on: (i) the severity (scale, scope, and remediability) and, when appropriate, the likelihood of actual and potential negative impacts on people and the environment; (ii) the scale, scope, and likelihood of actual positive impacts on people and the environment connected with companies’ operations and value chains; and (iii) the urgency derived from social or environmental public policy goals and planetary boundaries.”

Materiality Assessment Procedure:

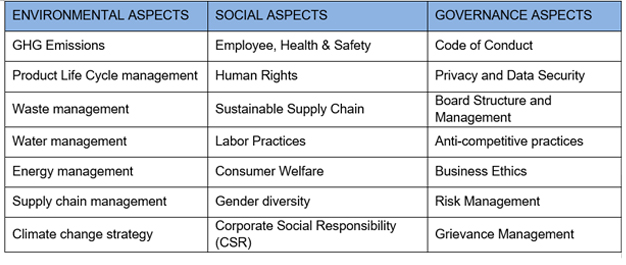

Materiality assessment identifies thematic areas in Environmental, Social and Governance related areas of the organisation through a well-defined, systematic process. Some major aspects covered in ESG materiality assessment are as follows –

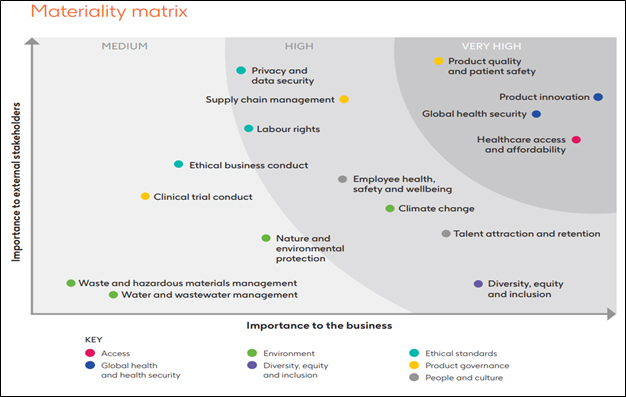

For materiality assessment procedures, the most widely used standards are the Global Reporting Initiative (GRI) and the AA1000 Accountability Principles by Accountability. Both standards require stakeholder engagement for materiality assessments. AA1000AP establishes eleven materiality compliance requirements for organisations to follow, which are grouped into three sections: commitment, integration, and capacity building. GRI 102-46, 102-47, and 103-1 are guidelines for materiality topics in GRI standards. There are four levels of materiality evaluation in GRI G4, which are identification, priority, validation, and review. It also recommends the use of a prioritisation matrix for presenting material subjects. The first dimension, “influence on stakeholders,” has to be shown on a vertical axis. On the horizontal axis, the importance of economic, environmental, and social consequences can be depicted. This is also referred to as the “materiality matrix,” where ESG issues can be plotted as medium, high, and very high.

We are taking a case study of the materiality assessment of GlaxoSmithKline Pharmaceutical Ltd. for the years 2021–22. It has laid down three major steps: issue analysis, stakeholder engagement, and generating a materiality matrix. The “GSK Materiality Assessment” document mentions that interviews were conducted with 13 key internal and external stakeholders, specifically chosen for their range of experience and perspectives on the list of material ESG issues. Internal stakeholders included representation of key business functions, including innovation, supply chain, human resources, risk and compliance, sustainability, and government affairs. External interviews aimed to represent a range of stakeholder groups, including investors, patient advocacy groups, multilateral health agencies, and not-for-profit foundations. Following is the materiality matrix developed based on the process followed. As GSK is a pharmaceutical company, its most pressing issues are product quality and patient safety, product innovation, global health security, healthcare access, and affordability.

These are some major steps that organisations can adopt for materiality assessment:

ESG Materiality Assessment Validation and Reporting

ESG Materiality Assessment results should be communicated to the board to ensure awareness of important risks and opportunities effecting company value creation. The process and results of ESG material assessment should also be communicated to other departments, such as risk management, finance, etc. The next step is to consider how results of materiality assessment are reflected in the company’s strategy, targets, incentives, risk assessments and business opportunities.

External reporting of ESG materiality assessments is important for stakeholders to understand the complete process. This will also make the process transparent, and concerns about the subjectivity or bias of materiality analysis will not be raised. Many companies, in their ESG and sustainability reports, disclose approaches to identifying stakeholders and material topics. For example, Reliance Industries Ltd. conducted a materiality assessment for a listed entity during FY 2021–22. The selection of material topics involved identifying probable material issues considering international reporting standards and the priorities of peers. Subsequently, key internal and external stakeholders that have an impact and influence on Reliance were identified for the materiality assessment. The inputs of the identified stakeholders on the probable material issues were captured through relevant stakeholder engagement mechanisms. A detailed analysis of each probable material issue was captured through relevant stakeholder engagement mechanisms. A detailed analysis of each probable material issue was undertaken, considering the input of stakeholders and management. Further, the material topics were prioritised considering both management and stakeholder perspectives.

Some important aspects with regard to disclosure of ESG Materiality Assessment are as follows –

Quote:

The development of ESG reporting practices depends on a holistic approach based on material ESG matters and not merely the extraction of historic ESG data within organisations.

She is the CEO and co-founder of Aumyaa Consulting Services. She has more than two decades of experience in the fields of process, control, and technology risk advisory. She is a CA, CISA, and DISA and has worked as the Director of the Risk Advisory Function at Deloitte. Her key focus is business and IT process risk advisory and audit. Currently, she is a Board of Governor member of the IIA Delhi chapter and a board member of the IIA Delhi chapter women forum. She is also registered in the IICA-maintained Independent Director Database.

She is a partner at Aumyaa Consulting Services with 21 years+ experience in internal audit, social audit, ESG, BRSR reporting, risk and compliance, policymaking, and research. She is CA, DISA, and was the Secretary, Sustainability Reporting Standards Board, of the Institute of Chartered Accountants of India. She has contributed to the development of standards and guides. She has worked as a knowledge and quality partner and has reviewed IS Audit, IFC, SOC, SOX, and IA engagements at Aumyaa.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories