Connect Us

Connect Us

Jul 06, 2023

Jul 06, 2023

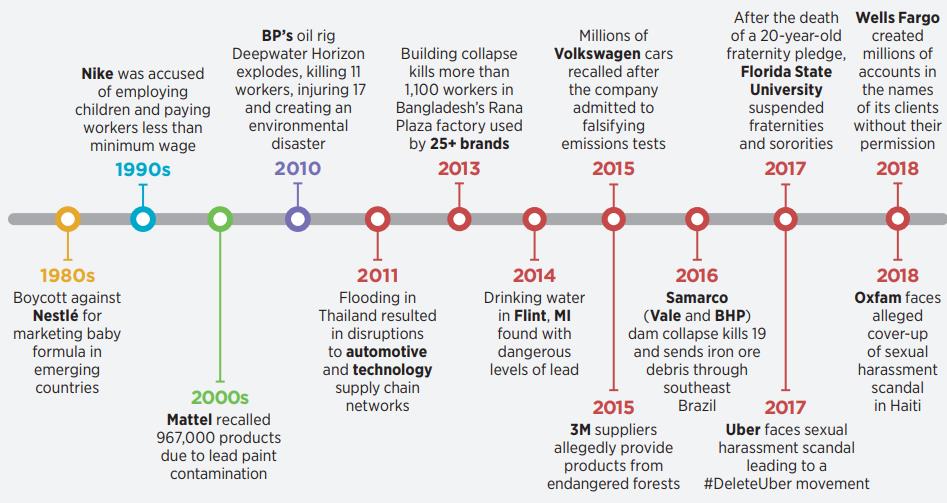

Conducting business responsibly has long been a topic of boardroom discussion. However, it was only as recently as the last decade or two that it got people talking about it. What should have been a proactive approach by anticipating plausible scenarios became more of a reactive response due to certain happenings that went wrong drastically. Nevertheless, regulators, investors and most importantly customers these days are pushing hard for corporations to be more transparent. There is a larger consensus that doing the bare minimum isn’t enough and that organizations need to go above and beyond when it comes to embedding ESG-centric practices in their business.

In the wagon wheel below, landmark events strengthened the case for ESG and corporates have been mentioned.

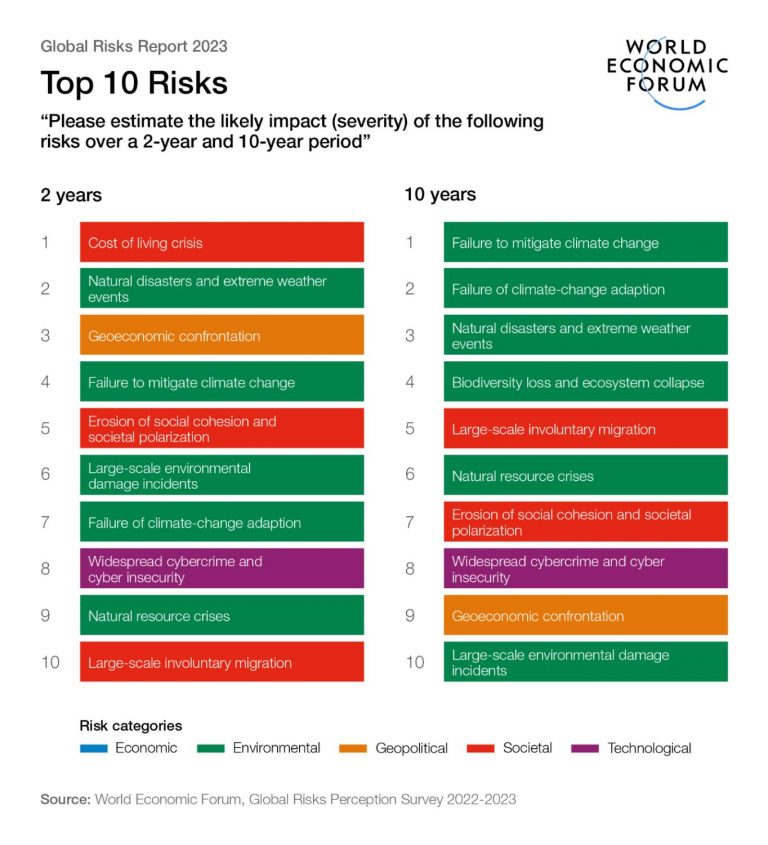

Top Global Risks

Environmental, Social, and Governance (ESG) risks refer to factors that can have a significant impact on the long-term performance of a company or an economy. Here are some of the top ESG global risks:

Climate Change – the increasing frequency and severity of natural disasters, such as floods, droughts, and hurricanes, can disrupt supply chains, damage infrastructure, and lead to financial losses.

Cybersecurity – as companies increasingly rely on digital technologies, they become more vulnerable to cyber-attacks, which can lead to loss of customer data, reputation damage, and financial losses.

Social Inequality – rising income inequality, discrimination, and social unrest can negatively impact business operations, consumer demand, and investor confidence.

Corporate Governance – lack of transparency, unethical behavior, and boardroom conflicts can lead to reputational damage, legal liabilities, and financial losses.

Human Capital Management – failure to manage workforce diversity, safety, and development can lead to high employee turnover, low productivity, and reputational damage.

Supply Chain Management – lack of visibility into suppliers’ labor practices, environmental impact, and financial stability can lead to reputational damage, regulatory fines, and business disruptions.

Political Instability – changes in government policies, social unrest, and geopolitical tensions can create uncertainty, increase operational risks, and disrupt business operations.

These risks are interconnected and can have significant impacts on each other. Therefore, companies and investors should adopt a holistic approach to manage ESG risks. The latest report of the World Economic forum highlights these global risks.

Framework for Risk Management: A framework for risk management typically involves the following steps:

A framework for risk management typically involves the following steps:

By following these steps, organizations can develop an effective risk management framework that helps to identify, assess, and manage risks in a structured and systematic way.

In conclusion, effective risk management is critical for organizations of all sizes and industries and can be ensured by closely embedding ESG issues within it.

Quote: There is a larger consensus that doing the bare minimum isn’t enough and that organizations need to go above and beyond when it comes to embedding ESG-centric practices in their business.

He is an Independent Director with 25+ years of experience in starting and growing business for global companies in India. He is award winning entrepreneur, author, and mentor for government’s Atal Innovation Mission. He is an expert in ESG and B2B sales and has published papers on smart and sustainable infra on AI in lighting products.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories