Payment

Payment

Connect Us

Connect Us

Mar 06, 2023

Mar 06, 2023

With the shortening of the economic cycles and the increasing likelihood of unforeseen economic uncertainties, the role of Independent Directors (IDs) has become more critical than ever in balancing shareholder and management interests. The need for stability and repositioning to meet changing business environments has become critical and therefore, it is a top priority for IDs to determine, assess, and respond to risks that businesses face. This article dives into some institutional arrangements that are key for business strategy management and sustainable firm-level decision making.

Heightened global economic uncertainty, India remains in a relatively bright spot

| Sharper than expected slowdown in global economic activity, driven by geopolitical uncertainty and inflationary pressures |

Over the past two decades, global economies have been shaken by unprecedented disruptions, such as the great recession of 2008, COVID-19, and the ongoing Russia-Ukraine war. The COVID-19 outbreak continues to haunt financial markets despite the easing of regulations and travel restrictions. While the effects of COVID-19 continued to linger, the onset of the Russia-Ukraine war peaked uncertainty and clouded the 2022 economic outlook. The war has led to additional upward pressure on prices due to disruptions in global and regional supply chains, resulting in input shortages, especially in food and energy. In addition, geopolitical fragmentation, such as the US-China trade tensions have imposed significant costs on both economies with US imports from China falling by double digits (Source: The US-China Trade War and Prospects for ASEAN Economies). Persistent and broadening inflation pressures have triggered rapid and synchronised tightening of monetary conditions, including Fed rate hike, alongside a powerful appreciation of the US dollar against other currencies. Overall, the global economy is experiencing a sharper-than-expected slowdown with the highest inflation seen in decades. As a consequence, major economies are facing a gloomy and uncertain outlook with anticipated waves of mild recession, particularly in Europe and the US.

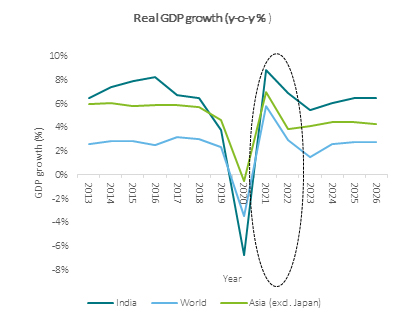

India has managed to remain in a “relatively bright spot” in economic growth, compared with other geographies. As per the International Monetary Fund (IMF), India is reflecting a positive outlook, with its GDP projected to grow by 7 percent during the fiscal year 2022-2023 (Source: Times of India article on “India ‘lesser affected’ economy from global recession, likely to be fastest-growing economy by FY26”). However, geopolitical tensions, tightening of global financial markets and the global economic slowdown do pose downside risks to the domestic outlook. As per RBI estimates, the manufacturing sector witnessed a decline from 9.9 percent during 2021-22 to 4.8 percent during 2022-23 due to the escalation of input cost pressures and lingering disruptions in global value chains. Overall, India’s roadmap looks positive, with India’s real GDP growth expected to remain high, even in the next fiscal year (see Figure 1), as compared with the real GDP growth rate of other Asian countries and global economies (Source: Economist Intelligence Unit).

Figure 1: India’s real GDP growth as compared with global economies

With economies around the globe experiencing turbulence, there is growing pressure on businesses to stay afloat. For instance, companies with high fixed costs such as technology companies are experiencing a revenue decline, as imports have become costlier, causing profit margins to narrow down. Manufacturers are facing bloated inventories, forcing them to slow down output until demand recovers. Large companies are prone to mass layoffs to cut costs as reduced demand translates to lower production output, and lower output results in lesser demand for workers to meet the sale of their products and services. This is evident from the recent mass layoffs undertaken by tech giants wherein approximately 25,000 employees were laid off to cut costs and create a runway to stay afloat (Source: India Today article on Over 25000 employees fired in last few weeks: Twitter, Meta, Amazon layoffs in 10 points).

| Increased inclination for businesses to engage in improper business conduct to ride the storm |

As the financial pressures from economic uncertainties mount, there is an increased inclination for companies to engage in improper acts in order to address their immediate financial needs. To maintain investor appetite, companies often resort to financial misconduct, such as overstatement of revenue to make up for decreased consumer spending, inaccurate or non-reporting of liabilities, and manipulation of valuations by delaying the recording of losses in value of assets. In a nutshell, the line between acceptable behaviour from unethical behaviour blurs.

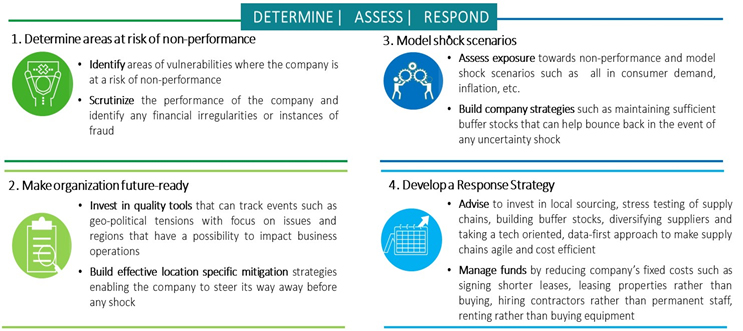

Role of IDs needs to evolve beyond improving corporate credibility and governance standards The role of an independent director needs to evolve beyond statutory requirements such as the annual and quarterly review of financial statements, compliance checks, and adequacy of internal control systems. As the saying goes, “the duck knows early when the river is warm in spring”; therefore, with the perspective of an advisory role, it is important for independent directors to ensure companies’ resilience to economic shocks. To ensure sustainable growth, independent directors will need to adopt a macro-vision so that any financial misconduct or instances of fraud can be corrected much before an economic shock hits.

While scaling a business, a board’s focus is often on the “path to profitability”; however, independent directors can explore different avenues could ensure stable growth coupled with sustainable profitability, while keeping uncertainty in mind. The illustration 2 below highlights some measures that an independent director could take towards ensuring that the company thrives under new circumstances (Source: HBR article – Visualizing the Rise of Global Economic Uncertainty).

Figure 2: Role of independent directors in building resilience amidst a changing business landscape

| Robust corporate governance with regard to ESG can increase a company’s intrinsic value and returns over the long term. |

In addition to ensuring smooth operations, it is critical for independent directors to make sure that the company is publicly disclosing its broader economic, environmental, and social impact and its future strategies to promote its Environmental, Social and Governance (ESG) goals. External stakeholders are increasingly using non-financial factors to identify material risks and growth opportunities of a company. A strong ESG proposition can attract global investors who are interested in allocating their capital to more promising and sustainable opportunities.

| Continuous assessment of geo-political risks is essential for minimal business disruption |

Further, the risk of supply-chain disruptions has increased with the growing geo-political tensions. For example, with Russia cutting deliveries to less than 20 percent of their 2021 levels, gas prices in Europe have increased more than four-fold since 2021, raising the prospect of energy shortages over the next year and beyond (Source: World Economic Outlook dated October 2022). It is imperative for IDs to ensure the continuous assessment of geo-political risks so that the ensuing business disruptions are adequately managed.

| The role of Independent Directors needs to evolve beyond statutory position to address key spheres of influence –the workplace, the marketplace, the supply chain, the community, and the public policy realm. |

The continued disruption caused by a series of economic shocks has increased the inherent risk of any financial misconduct across sectors. The enhanced scrutiny on management provides a compelling rationale for boards and the management to revisit and refresh the response strategy and ensure they remain fit for purpose. Although uncertainties do dampen business opportunities, the ensuing global uncertainty has propped significant opportunities for emerging markets, such as India, in terms of investment. Changes in China’s exports due to the US-China trade war and the weakening of global trade links with other major countries has provided new opportunities for India to position itself as an alternative manufacturing destination. If India is to position itself as an export hub, companies must improve consumer retention and focus the company strategies on strengthening supply chains. Therefore, the role of independent directors has to go beyond its existing statutory position to address key spheres of influence—the workplace, the marketplace, the supply chain, the community and the public policy realm.

He is a Partner in Financial Advisory at Deloitte India and leads Dispute & Litigation and Antitrust/ Competition Advisory practices. He is also the sector leader for the Infrastructure sector for Deloitte’s Financial Advisory Function in India. He has an overall experience of over 27 years across various roles covering credit assessments, business strategy, commercial contracts, investment banking, PE investments, forensic investigations, commercial disputes and antitrust matters.

He is the head of Deloitte Forensic practice in India. He holds over 16 years of professional experience of which he has spent over 10 years advising varied clients including corporates, financial institutions, hedge funds, and private equity funds on a wide range of Forensic services including Business Intelligence.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories