Connect Us

Connect Us

Aug 08, 2023

Aug 08, 2023

Background

“A small business is an amazing way to serve and leave an impact on the world you live in” – Nicole Snow

Small and Medium-sized Enterprises (SMEs) have emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. They not only play a crucial role in providing large employment opportunities at comparatively lower capital cost than large industries but also help in industrialization of rural & backward areas, thereby, reducing regional imbalances, assuring more equitable distribution of national income and wealth. SMEs are complementary to large industries as ancillary units and this sector contributes enormously to the socio-economic development of the country.

The SME Capital Market is a credible and efficient marketplace to bring about a convergence of sophisticated investors and growing corporates in India. It offers opportunities to inform investors to invest in emerging businesses with exciting growth plans, innovative business models, and commitment towards good governance and investor interest.

The SME Capital Market has customized processes and systems which will help prospective issuers in their journey of metamorphosing into listed public companies. The SME platform will provide capital raising opportunities to credible and fast-growing businesses with good governance standards. It will be an ideal platform to raise funds for companies on a growth path, but not large enough to list on the mainboard.

MSME – Classification in India w.e.f. 01-07-2020

MSME stands for MICRO, SMALL and MEDIUM Enterprises. It covers manufacturing enterprises and enterprises rendering services.

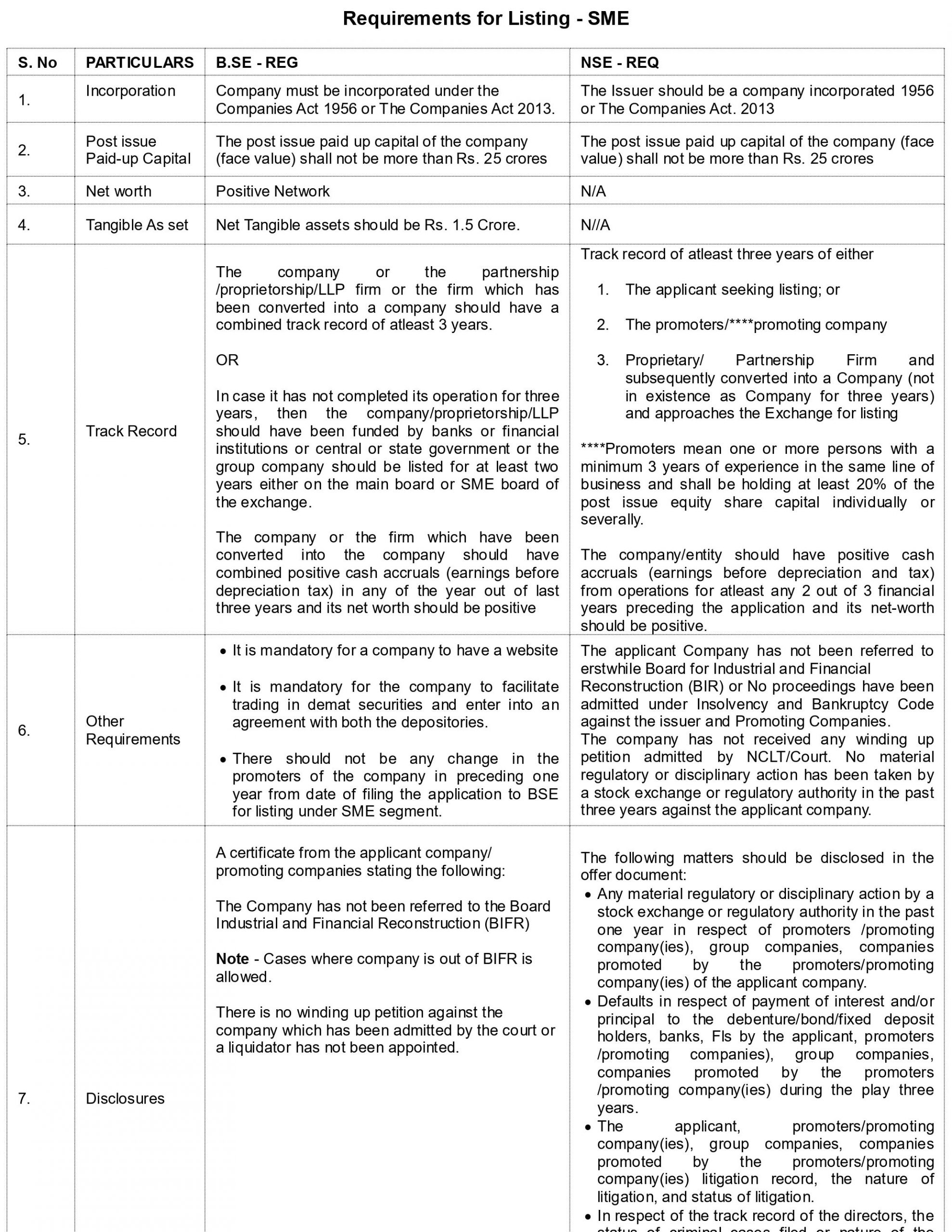

SME Listing on Stock Exchange

Under the guidance and monitoring of the Securities Exchange Board of India, BSE Ltd. had launched its SME platform – BSE SME Platform and the National Stock Exchange of India Limited (NSE) had launched its platform ‘NSE Emerge’ in 2012. These Platforms offer a unique opportunity to aspiring SMEs to raise capital, unlock their value and get listed on a nationwide stock exchange. They provide guidance to SMEs on the process required to list and introduce them to intermediaries that can assist such companies in listing.

Small and Medium Size Enterprises have difficulty accessing Equity Capital from public sources. They are forced to access capital from family and friends. However, this source also has its own limitations. Hence, many of them try to raise equity from non-private sources such as Alternate Investment Funds (AIF). The return expectation by the AIFs, governance issues, transaction size and cost make it less attractive for the SMEs.

The size of funds required by the SMEs make main board issues an unattractive proposition. It is with this need in mind that regulators have created the SME Exchanges. These SME Exchanges address the issue of size, cost, control etc. that are vital for functioning of the SMEs.

The Benefits of listing on the SME Exchange

At this stage, it is worth noting what Peter Lynch said “I think you have to learn that there’s a company behind every stock and there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies

SME IPO & Listing

When an unlisted company seeks to raise money by selling securities or shares to the public for the first time, it announces an Initial Public Offering (IPO). In other terms, it is the public sale of securities on the primary market.

In 2021, initial public offerings by firms rose to about 63, the highest since 2010. Not just that, in the previous year, these IPOs raised a record-breaking amount of Rs. 1,19,882 crores (USD 15.4 billion) in total as well.

However, one thing we all need to remember is that not all of them are created equal, and not all new companies that issue their first stock are successful ones. Thus, if you are investing for the first time, you should be wary of some pros & cons of IPO.

As mentioned above, an Initial Public Offering allows the company to issue security by selling its stock to the general public. It is a type of sale that most companies do to raise capital. New securities issued for the first time are dealt with in a primary market.

The company became publicly traded, and its shares are available for free open market trading when listed on a stock exchange. The process can be quite costly but, at the same time, easy, making it an ideal option for those who lack money or time to conduct due diligence in their business.

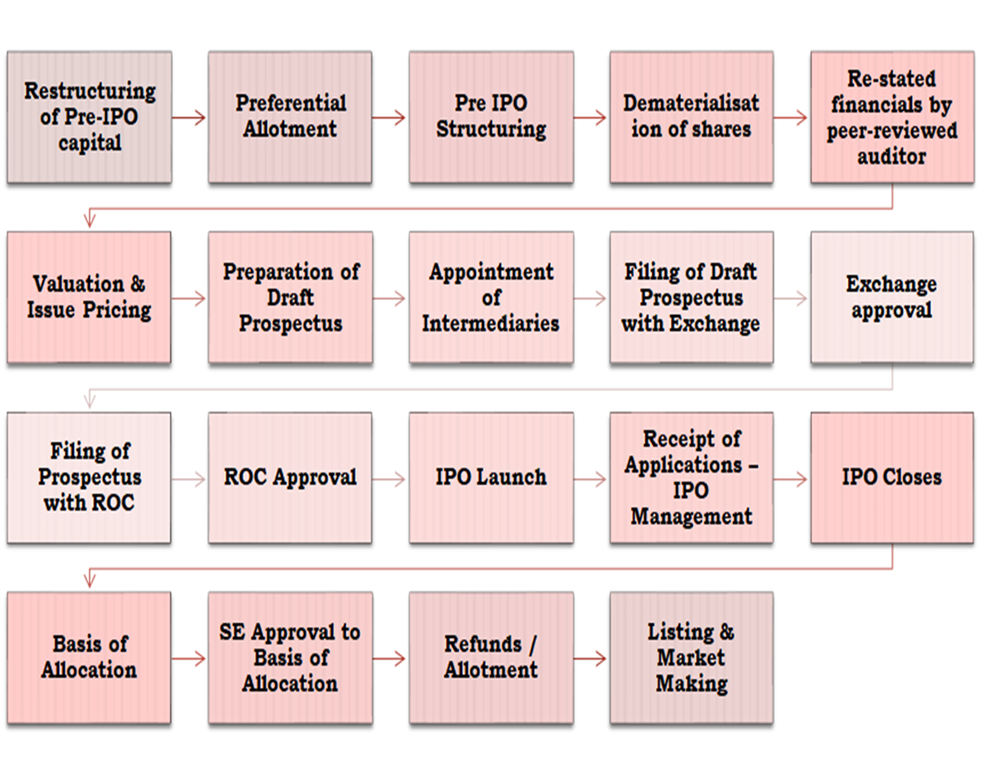

SME IPO can be completed in 60 days subject to availability of all the documents & Approvals.

Procedure Flow Chart

Source: WIRC Reference Manual 2022-23

Choosing an initial public offering has several benefits over staying private, especially if your business grows rampantly. Below mentioned are some of the significant pros & cons of IPO you should be aware of:

Pros & Cons of IPO

| Pros | Cons |

| Capital Access | Higher starting cost. |

| Gaining Visibility & Recognition | Increased pressure to deliver results |

| More Options & Flexibility | Financial reporting becomes public |

| Transparency | More administrative work. |

| Helps in achieving Long Term Objective | Distractions caused by the IPO process. |

| Better Liquidity | Less Autonomy |

| Entity can raise lot of Cash & fast | |

| Helps in achieving financial health | |

| Helps in attracting & retaining Talent | |

| Creates better perception for the entity | |

| Better negotiation / bargaining power |

Conclusions

There is no simple answer to the question as to whether an entity should go for IPO and Stock Listing. Investing in a listed company is preferred by investors due to easy exit opportunities. Listed companies are under obligation to give timely disclosures and follow all the compliances. An IPO is a big step for a company as it provides the company with access to raising a lot of money. This gives the company a greater ability to grow and expand. The increased transparency and share listing credibility can also be a factor in helping it obtain better terms when seeking borrowed funds as well. This transparency boosts investments as it creates confidence amongst the investors. Further, a company can raise capital pursuant to the IPO through FPO and Private Placements. It can also delist itself from the stock exchanges. It all depends on the entity’s ‘Purpose’, Strategy’ and ‘Growth aspirations etc. However overall, the pros of listing and going for IPO far outweighs the cons and hence going for IPO & Stock listing is not only a good proposition but may be a sound business decision.

He is Managing Director of Century Textiles and Industries Ltd., Aditya Birla Group

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories