Connect Us

Connect Us

Jul 06, 2023

Jul 06, 2023

Benefit is debatable, value is not…

The corporate world is in a tizzy with the alphabet soup going hot and cold. From (Sustainable Development Goals (SDGs) to Corporate Social Responsibility (CSR) to Diversity, Equity & Inclusion (DEI) to Environment, Social, Governance (ESG), which framework is the one to follow is an existential question in Boardrooms and beyond. As corporate managers grapple with the many decisions to form smooth operations and push revenues, compliance is a need that has to be met, and yet the unasked question is why? Why should we do this, and what is in it for us? A simple answer is that it will benefit your organisation. Unfortunately, benefit is something that is sold, and it is only when the buyer sees value that it sells. We may share as much evidence as possible on the benefit of a product or service, but until that benefit is relevant to the buyer, it does not mean anything. Much the same is true of our alphabet soup: the business community believes that the different initiatives around SDGs, CSR, DEI, and ESG have benefits, but many are yet to be convinced of their value in contributing to their bottom line. So, what will it take to create value?

From Compliance to Commitment

Every enterprise, big or small, multi-national or domestic have 2 key assets – People and Money and how you value them will determine the value you create. Actually, not create but co-create, why? Because business does not operate in a vacuum and it takes a diverse set of actors and stakeholders to create an environment in which it can function and thrive.

Every business seeks to attract the right kind of people, be they as employees, customers or vendors. It also has to invest its money is such a manner to ensure the best return on investment. Mapping the convergence of these two assets can create the pathways of transformation not just for the business but for the eco-system in which it exists.

Every corporation has a set of policies by which it abides to steer operations. As seen during the pandemic, changing policies that are sensitive to their team or customer needs ensures continuity and stability. Hence, crafting Responsible Policies not only attracts the right consumers of these policies (be they employees or customers) but also results in the right messaging to the eco-system. Call it ethical branding if you will, but that is what Consumers want, to trust the business they are associated or deal with. Brand loyalty is not the easiest of corporate objectives and yet Responsible Consumers can be the insurance for growth. And that is the beginning of value co-creation.

Every organisation also needs to procure goods and services in order to function. How and where they use their funds also can determine where and how much they pay to get those funds. The cost of capital can make or break corporations. Diversifying the vendor base to purchase from women owned businesses and differently-abled entrepreneurs not only accelerate economic and social development but also open the doors to ESG funds to access Inclusive Capital at competitive rates. Inclusive Procurement can indeed be a win-win strategy.

Most establishments would like to continue to exist and create a legacy for themselves. This calls for investment for the long term. To ensure longevity, it will take a deeper understanding of the true cost of operations across the life cycle of an organisation and the adoption of practices that may seem untenable in the short term. Sustainable Practices will build Sustainable Capacity that will hold the business in good stead and keep it established.

Last but certainly not least, every entity, and I do mean every entity, is part of a larger eco-system, as I mentioned earlier, but not just with actors and stakeholders. It’s the whole environment in which it operates: political, legal, social, physical, and more. How it associates with each can have ramifications for the long haul. Partnerships that are based on a concern for the ecosystem and commitment to the well-being of the Communities it is surrounded by, will beget Social Capital far beyond any value that financial capital can create.

Balanced Innovation Framework for Transformation…

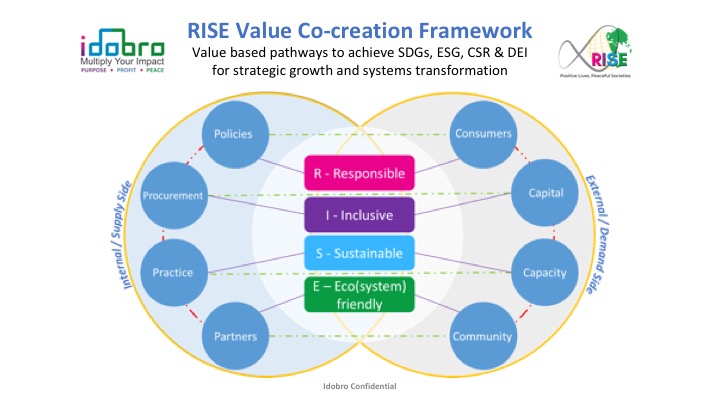

With a plethora of compliance frameworks and tools, organisations can get overwhelmed to plan, execute, and monitor their actions for positive outcomes. The RISE Value Co-creation Framework (RVCF) is a powerful tool for businesses looking to create value and drive social change in a sustainable and responsible manner. The RVCF is a precursor toolkit to demystify ESG for managers to better understand their roles and responsibilities and build commitment to the organisation and its purpose in society.

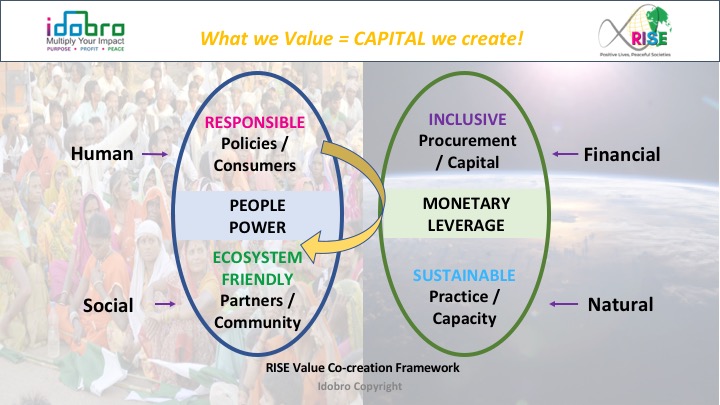

Accumulating capital in its various forms beyond financial capital – Human, Social and Natural Capital will harness the power of people while leveraging funds to benefit all.

The RVC Framework provides a holistic view of operations so as to avoid the pitfalls of isolated pilots and projects of excellence that cannot scale to deliver for the organisation as a whole. A balanced approach to innovation and cultural change is critical to establish the pathways of transformation.

By following these pathways of transformation, businesses can not only improve their bottom line but also make a positive impact on society and the environment. The specific pathways of transformation outlined can serve as a valuable guide for businesses looking to navigate the challenges of today’s rapidly changing world and be more VUCA and future-ready.

The RISE values – Responsible, Inclusive, Sustainable and Eco-system friendly, are universal drivers of positive action for people and planet.

The RVC Framework is underpinned by the RISE Values – Responsible, Inclusive, Sustainable and Eco-system friendly. The RISE values are universal and inherent in varying degrees in all entities (individuals or institutions). When they are in sync with others and the eco-system, they become powerful drivers of positive action for people and planet.

A virtuous and iterative cycle for strategic growth…

Irrespective of the acronym an organisation chooses to implement, a clear roadmap is the need of the hour for businesses to transition towards sustainable and responsible growth.

As outlined in the RVC Framework, as each element of the compliance piece moves towards an action of commitment, a domino effect is created and interconnectedness realised.

Inclusive Procurement will be funded by capital that will demand more Responsible Policies that will attract more Responsible Consumers. The same holds true for Partnerships that will build Communities who in turn will demand Sustainable Practices for capacity befitting a Corporate Citizen. Market based solutions driven by external demand and met through internal supply will sustain the value co-creation process in the long run. And so, the mutually enforcing cycle continues as nested, iterative pathways for strategic growth and transformation.

Systems approach to Capital Accumulation

Money makes the world go around. True, but it is people who decide how money goes around. Valuing a people-first approach will also protect our planet. As the saying goes, you cannot eat money.

As economic structures fail humanity and the earth, there is a critical and urgent need to build human capital beyond the elite 1%, social capital that leaves no one behind and natural capital that will sustain our future generations. Human capital development will unleash the potential of people, fostering innovation, productivity and well-being. By strengthening Social Capital, we leverage collective efforts for common good while by investing in natural capital and protecting it; we preserve bio-diversity and fight climate change to create more stable environments for us to function within.

Accumulating capital in its various forms beyond financial capital-human, social, and natural capital-will harness the power of people while leveraging funds to benefit all. This requires systems thinking, interaction, and engagement with diverse stakeholders that creates value, not just in the eyes of the beholder but also brings back value for the initiator. This is thought-based leadership at its best.

‘Put Your Money Where Your Values Are’

– Nasdaq

Quote:

Every enterprise, big or small, multinational or domestic, has two key assets: people and money, and how you value them will determine the value you create.

She is the Chief Impact Officer & MD of Idobro Impact Solutions and Managing Trustee, RISE Infinity Foundation with 25 years cross-functional experience in Technology, Finance, Education, Gemology and Development. An academician at heart, she has designed and implemented frameworks for Value based Leadership and built eco-systems on the foundation of Purpose, Profit and Peace. She is a Chevening CRISP Fellow from Oxford, UK and a Senior Fellow at the Institute for Social Innovation, US.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories